|

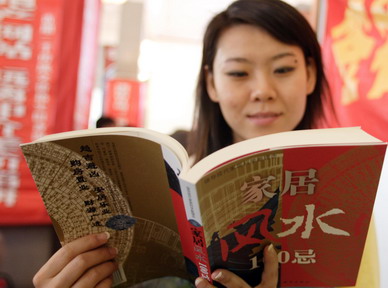

| Reading up on feng shui could improve your financial skills.[CFP] |

HONG KONG: While financial analysts read all sorts of indexes to form a picture of the economy, feng shui experts in Hong Kong are applying their art to a similar end.

Peter So, a popular local feng shui master, is trying to convince undecided investors not to purchase property in Hong Kong until 2015.

So said past experience showed the city's property prices rising continuously for five years and then falling over the next six. He said prices peaked in 2009, the final year of the last cycle, and were now due to tumble.

"The theory has never been wrong in the past," said So. "Apartment prices fell in value almost 50 percent between 1986 and 1991 and then rebounded to another high in 1997. They slumped again in 2003 because of the breakout of SARS, and it is acknowledged that property prices have been way up over the past few years, even though the city's economy was damaged severely by the global financial crisis."

So said the next bottoming of the property market would occur in 2015 and he had now started saving money ahead of the eventuality.

As to stocks, So eschewed predicting whether it would be a lucrative market or not this year, but advised investors to differentiate odd years from even ones when buying, a tactic he said was effective eight times of 10.

"Though the stock market is volatile, rough fluctuations still can be determined. Generally, the market rises high initially but ends low in odd years. The trend reverses in even years. This is an even year, so investors should consider buying stocks in May or June, when the market will be at the year's bottom," said So.

However, just like the mercurial markets, predictions from different feng shui masters vary, sometimes considerably.

Edwin Ma, another local feng shui master, disagrees with So about the city's property market.

"If I am to make a suggestion to my clients, I will definitely advise them to pour money into the property market this year," Ma said.

Ma anticipates a flat year in housing prices, but he said it was still worth investing since "in comparison with stocks, property prices are de facto guaranteed to make a fortune, while most stocks were not".

He added: "The stock market seemed exuberant last year, but it has become the playground only for rich people because profitable stocks were no longer affordable to most ordinary investors."

Ma said although the Hang Seng Index ended high in 2009, most investors were unhappy because star stocks such as HSBC had surged to more than HK$80 a share - far beyond their affordability. However, any cheap stocks they were holding barely made money, or even dwindled in value over the year.

Ma also warned people born in the years of the tiger, monkey or snake to be extra cautious with money in 2010.

Feng shui is an ancient Chinese aesthetics system believed to apply the laws of both heaven (astronomy) and earth (geography) to help people improve their lives. Cynics say it is based solely on anecdote or guesswork and lacks plausibility. However, feng shui is extremely popular in China and is growing in popularity in many foreign countries.

***

Related Links

Foreign direct investment falls again in China

China's FDI Plateaus as Investment Demographics Shift

Chinese Overseas Direct Investment Hits a Wall

Warning’╝ÜThe use of any news and articles published on eChinacities.com without written permission from eChinacities.com constitutes copyright infringement, and legal action can be taken.

All comments are subject to moderation by eChinacities.com staff. Because we wish to encourage healthy and productive dialogue we ask that all comments remain polite, free of profanity or name calling, and relevant to the original post and subsequent discussion. Comments will not be deleted because of the viewpoints they express, only if the mode of expression itself is inappropriate.

Please login to add a comment. Click here to login immediately.