Whether you have mountains of student loans and credit card debt looming or you're just looking to dump some red notes into your hometown bank, it's important to find the cheapest way to transfer your hard-earned RMBs to your overseas bank accounts. Having personally done this numerous times, I had to learn the hard way (i.e., lost a lot of money) how to transfer money overseas. There are three main methods for taking care of this problem, but finding the cheapest, least-nerve-racking way to do this can be difficult for a first-timer.

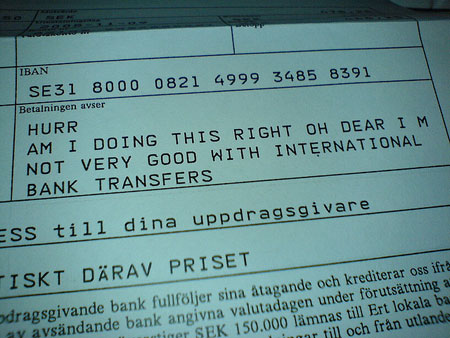

Transferring money overseas can be difficult sometimes.

Source: kalleboo

A quick note about changing RMBs into foreign currencies: if you are a foreign national living in China you are only allowed to change a little over 3,000 RMB (500 USD) per day into the foreign currency of your choice. Conversely, if you are Chinese, you're able to exchange up to 50,000 RMB into foreign currency per year.

Also, prepare for a decent amount of stress. Just like dealing with any other "official" process in China, you will have to spend at least a couple hours ensuring all the necessary documents and translations are correct. So, go in there with all your important documents and some good humor and hopefully you'll be able get out a couple hours later without a huge headache.

1) Banks (account transfers)

Banks are the most obvious solution to transferring money to your overseas bank accounts. Regardless of the bank you use, you are going to need to bring a few documents. First, obviously, is your passport; they won't even deal with you without it. Most banks require you to have an account with them before they allow you to transfer funds. When I've transferred funds in the past, this was the case at both Bank of China and ICBC. You'll also need to bring all the account information (branch number, account number, institute number, and branch's address in your country) for your overseas bank. It's important that you don't forget to include your bank's SWIFT code and routing number. You can find your bank's SWIFT code on a number of specialized websites, such as: www.theswiftcodes.com. It should look something like this: CHASUS33 or MRMDUS33 IPB. Or you can always just call your hometown bank branch up and ask.

So, here is where it gets a bit tricky. Depending on the bank, you may have to change your RMB into foreign currency FIRST. At the Bank of China, they made me fill out a separate form to convert the RMB into dollars, and then when I physically had the American currency, I had to turn around and deposit it into the Bank of China account, and ONLY THEN I could transfer to my American bank account (They probably do this so they can make more money off the currency exchange fees). However, at ICBC, they will convert the RMB into foreign currency in-bank so you don't have to go through the stress of personally exchanging the currency. Just make sure to check this with your bank before they start unnecessarily charging you for things.

Speaking of fees, depending on the bank you can expect to drop at least a couple hundred 100 RMB notes. Usually they have a flat fee for the transfer and then a fee for a certain intervals over that amount. Make sure to get both the flat fee and the interval fee first to avoid a frustrating surprise later on. Lastly, make sure to check with your hometown bank as to whether they have transfer fees as well, because you may end up getting hit with two transactions fees, one outgoing (the Chinese bank) and one incoming (the foreign bank).

After the dust has settled, you can expect the money to be in your foreign bank account anywhere from 5 to 10 days depending on the banks.

2) Western Union

A wire transfer through Western Union (Ķź┐ķā©Ķüöńø¤) is the main alternative to account transfers between banks. Note that Western Union is only used in some Chinese banks: Agricultural Bank of China, China Construction Banks, and Postal Savings Bank to name a few. You can view their full list on the Western Union website.

Western Union is generally faster than account transfers and they provide tracking codes to follow your money. The thing you will have to remember when using Western Union, as opposed to an account transfer, is that you will need someone back in your home country to pick up the transfer for you. So, not only are you going to need your personal information, you're also going to need all of the receiver's information (name, address, city, state, country, gender). Also, if you are sending more than 1,000 USD, the receiver will need an ID and answer the security question that you provide when you first start the transfer.

In terms of fees you're looking at a similar situation with the account transfers, 20 USD for transfer amounts up to 1000 USD and increasing intervals for amounts over 1000 USD. Also note that Western Union makes money off the exchange rates as well, so like the Bank of China above, you'll have to change the RMB into the currencies of your choice first, and then proceed to wire the money over. Depending on whom you bank with in China and your home country, Western Union can be a cheaper, easier choice.

3) The old fashioned way: bring it with you

This way doesn't technically cost you anything, but it is perhaps the most nerve-racking method you have at your disposal. You strap cash to your body like an international drug smuggler and make your way back to your home country by hook or crook. According the government regulations, which you can conveniently find on the China entry-exit documents, the most money you can bring with you in cash is 10,000 RMB or the equivalent of 5,000 USD in other foreign currencies. If you are bringing more than those amounts on the plane, you are supposed to declare amounts between 5,000 USD to 10,000 USD with customs. Taking out more than 10,000 USD will require you to get a special permit used by the State Administration of Foreign Exchange. If you take out more than 5,000 USD without declaring, you run the risk of having trouble with the authorities or worse, having your money confiscated.

Warning’╝ÜThe use of any news and articles published on eChinacities.com without written permission from eChinacities.com constitutes copyright infringement, and legal action can be taken.

Keywords: Transferring money overseas international transfers from China

All comments are subject to moderation by eChinacities.com staff. Because we wish to encourage healthy and productive dialogue we ask that all comments remain polite, free of profanity or name calling, and relevant to the original post and subsequent discussion. Comments will not be deleted because of the viewpoints they express, only if the mode of expression itself is inappropriate.

Please login to add a comment. Click here to login immediately.

Hello Applicant, I am Mr. William from Capital Funding Solution, ┬®Inc. We offer loan to serious minded individuals and firms who are sincere, honest and God fearing. We give out loans with a fixed interest rate of 2.8% yearly with repayment term of 1 to 30 years depending on the loan amount. We understand you are interested in getting a loan from the company. Understand we are so much ready to help you at this point of time. So, to enable us proceed further on the transfer. Please Kindly go to our website by clicking the link below or E-mail capitalfundingsolutions@outlook.com Read and follow the instruction carefully.

Dec 29, 2017 08:48 Report Abuse

I need to transfer money to Shaoxing from Switzerland. My daughter is studying there. Any ideas on most efficient and inexpensive way to do?

Oct 24, 2016 19:24 Report Abuse

i have way on how to transfer money from china to other countries.

Aug 06, 2016 11:37 Report Abuse

Is it practically possible to get either a visa or a mastercard debit card issued by a Chinese bank if you're one of them "foreigners? without having to pay gazillion trillion dollars or having to open bank accounts with minimum balance of 45 billion rmb???

May 09, 2014 16:53 Report Abuse

My way: Step 1 Take money out of CCB (3100 RMB usually) Step 2 Take money to Bank of China to convert to USD(free, just bring cash and passport) Step 3 Take money to another CCB across town to wire transfer(handling fee, less than 100 RMB) Step 4 Wait for it to appear in Bank of America. Step 5 Wait for Bank of America to take out $15 Wire fee

Feb 20, 2014 10:55 Report Abuse

What about through HSBC? My friend has an HSBC premier account in the UK. Would I be able to go into an HSBC branch in China and pay money into his account from here or would I still have to go through the process of form filling and paying a fee?

Nov 27, 2013 23:25 Report Abuse

If you have HSBC Premier account, you can withdraw from HSBC ATM (up to RMB 2500 each time, twice daily) or others (ICBC: up to RMB 3000 each time, twice daily) without any transaction or foreign exchange charge (from neither bank). So far, this is the best way for me to access my US account from China.

Dec 20, 2013 13:14 Report Abuse

China restricts the free trade of its currency in order to offset the imbalance that other central banks cause by loose monetary policies. The WTO has complained about China's methods of trying to control interest and exchange rates. But it's no different than what the FED or the ECB does. They just restrict trade instead of increasing or decreasing the supply of money. This is the reason for the quotas (500 USD daily limit) set on foreign currency exchange. China will never admit it, but there is a desire to suppress the value of the Chinese Yuan because ChinaŌĆÖs economy is dependent on offering the world cheap goods. China is mad at the USA for printing more money because now US exports are more competitive with Chinese exports. I think itŌĆÖs LAUGHABLE that CCTV news complains about the USAŌĆÖs policy and talks about moving away from the US dollar as the worldŌĆÖs reserve currency. As if the Chinese Yuan is a better option? Do you trust the Yuan, especially knowing that the Chinese government sets quotas on the amount of money you can trade? Can you imagine what it would be like if we based world trade on the Chinese Yuan? If they restrict the exchange of money, then this would be in effect, restricting the trade of goods. Nope! Not going to happen anytime soon. If China wants to make their Yuan more reputable, then they need to float it on the open market and stop the daily limits (quotas). There is a silver lining to living in China. The fact that China makes you convert your cash before sending it is actually very beneficial to you as a consumer. The exchange rate that most American banks will give you is usury.

Nov 26, 2013 23:42 Report Abuse

Lazy, incompetent clerks at the local Bank of China turned me down yet again. They say I can't convert my basic account into an internet banking account (necessary for international bank transfer) because I'm a foreigner. But their website and BoC info hotline says otherwise. I know they're lying to get me out of their monolingual faces before they lose face. That's what happens when local banks are run by a bunch of incompetent µŗ╝ńł╣ or ŌĆ£pindiesŌĆØ, who got their job through connections rather than ability. Oh well, from what I read, ICBC may be a bit cheaper, so perhaps I should try there. Still run the risk of another stupid µŗ╝ńł╣ saying no to me, and the rest of the staff following suit...

Nov 23, 2013 12:51 Report Abuse

try Citic bank of china, its cheaper(120 rmb or less per transaction upto 50K rmb) and faster and you can exchange more 2000 usd .

Nov 23, 2013 09:50 Report Abuse

I have two accounts with China Merchants bank. One of the cards I have here, the other one my mother has in my own country.

I transfer money through Merchants Bank online banking system (very easy once you know how) and ask her to withdraw it in and put it in my home bank account.

I do about 10,000rmb each time, and it costs me only a 10 yuan transfer fee.

Very simple, very safe (I trust my mother) and very cheap. And the only effort for me is transfering some money online and sending my mum an email to withdraw it. She does all the hard work.

Been doing it for more than a year, no hassles

Nov 06, 2012 20:17 Report Abuse

Two different accounts, set them up same day. They both sit together in my online banking, so it is piss easy to transfer funds to the card my old cheese has.

Nov 10, 2012 16:47 Report Abuse

The same thing happened to me when I was picking up a meager amount. They tried to say it wasn't my money. That was Bank of China. I hate that bank. I closed my account the minute I got the money in my hands. I finally shouted at them for two hours. I was also leaving for the airport and almost missed my flight because of these clowns.

Feb 15, 2015 05:55 Report Abuse