In a country where red means positive return (gain) and green means negative return (loss), finding the right investment where risk and reward are balanced can be, at times, difficult. Here’s how some of China’s wealthiest individuals invested their money in 2014.

- Internet related technology investments

- “Shadow banking”

- Alternative investments such as art, wine, watches and jewelry

The above three proved to be popular investment choices in China in 2014, it’s also possible that they’ll be good trends into 2015, though not all are built on solid fundamental value.

Photo: Attila Mexico

1) Alternative Investments

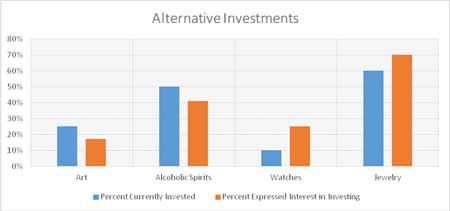

Alternative investments like art, wine, watches and jewelry surprisingly ranked third in popularity after real estate and stocks (equities), the global financial crisis driving much of this interest. The Hurun Institute describes this trend of investing in alternative assets a result of Chinese individuals looking beyond wealth creation and investing more based on passion. See the chart below for a breakdown of the popularity of the various types of alternative investments.

It would seem that of the alternative investments, watches and jewelry have the brightest prospects going forward, and art and alcoholic spirits seem to be in somewhat of a decline. One of the reasons investing in art may be waning may have to do with the recent popping of the art investment trend in 2011, where billions of dollars of wealth was lost.

Despite the fact that investment interest in alcoholic spirits is declining, it has been one of the largest areas of growth in recent years, so much that formal exchanges for rare spirits and wines have even been setup.

The reason why watches and jewelry are becoming more popular have to do with their high resale value and the low cost of collecting. Growth for these industries are ripe as Chinese individuals seek to diversify away from diamonds and into other precious stones and metals.

What’s the bottom line? Be wary of bubbles in the alternative assets space, and invest in what you know.

2) Shadow Banking

What has been happening recently in China is non-bank intermediaries have been raising money from individuals, then go on to invest in whatever they deem to provide the highest returns while paying these individuals a nominal annualized interest rate that is higher than what they could’ve gotten at a bank or financial institution.

Perhaps the two best examples of shadow banking are Alibaba’s “Yuebao” and high yield “Licai” (ńÉåĶ┤ó) products sold in brokerage houses. In Alibaba’s Yuebao, users can transfer their savings to get an interest rate that’s higher than what banks pay individuals to deposit money into savings accounts. High yield “Licai” products are fairly ubiquitous and while investors can get yields in excess of 8%, the funds are basically black boxes.

This is a particularly hot topic because the shadow banking sector as a whole is unregulated and now big enough ($4.39 Trillion US Dollars) to pose a systemic risk should there be widespread defaults. Because it is not regulated by any of China’s financial regulatory bodies, where the money comes from and what it invests in is also largely a mystery. Because the shadow banking sector has swollen to such a massive size, China’s central government has taken an interest in regulating the shadow banking sector and reducing the systemic risk it poses to China’s economy.

The bottom line: There can be good gains to be had, but regulation is a major risk, as the government can deem your particular shadow investment to be illegal and shut it down.

3) Internet Related Technology Investments

From early stage angel or seed funded companies to newly listed public companies, internet based technology companies have seen their valuations soar in recent years. Some notable pre-IPO companies that received funding in 2014 are:

- Dididache, a taxi-hailing app raised $700 million USD

- Meituan, a groupon-like internet firm raised $700 million USD

- Xiaomi, a manufacturer of mobile phones raised $1.1Billion USD with a valuation of $45 Billion USD

- Dazhong Dianping is also rumored to have raised $800 million USD in round E funding with plans to go public soon.

Two Chinese internet technology companies that went public in 2014 are:

- Alibaba goes public in the largest technology IPO ever - $21 Billion USD

- JD.com also goes public in 2014, raising $1.78 Billion USD

The general consensus is that at the moment, Chinese internet based technology companies are a little too hot at the moment and in a bubble, particularly those which have yet to go public, and that the companies that have gone public currently trade at high valuations already, making them less attractive as an investment vehicle.

Bottom line: It feels kind of like the dot-com boom, but MUCH bigger and in China. Some tech companies will be able to deliver real long-term gains to investors, but pick your companies carefully.

Warning’╝ÜThe use of any news and articles published on eChinacities.com without written permission from eChinacities.com constitutes copyright infringement, and legal action can be taken.

Keywords: Investments in China 2014 popular investment choices in China

All comments are subject to moderation by eChinacities.com staff. Because we wish to encourage healthy and productive dialogue we ask that all comments remain polite, free of profanity or name calling, and relevant to the original post and subsequent discussion. Comments will not be deleted because of the viewpoints they express, only if the mode of expression itself is inappropriate.

Please login to add a comment. Click here to login immediately.

Huge cultural differences. Ask around, see how many mainland chinese view money as a game.

Feb 10, 2015 13:40 Report Abuse

I don't think the watches in the picture are investment grade? :\

Feb 09, 2015 20:05 Report Abuse